Global Wealth Leadership

Where Old Money Meets New Markets: Isabela Herrera’s Discipline-First Power Play

Isabela Herrera Brings Four Ultra-Wealthy Family Legacies Into Regulated Digital Finance

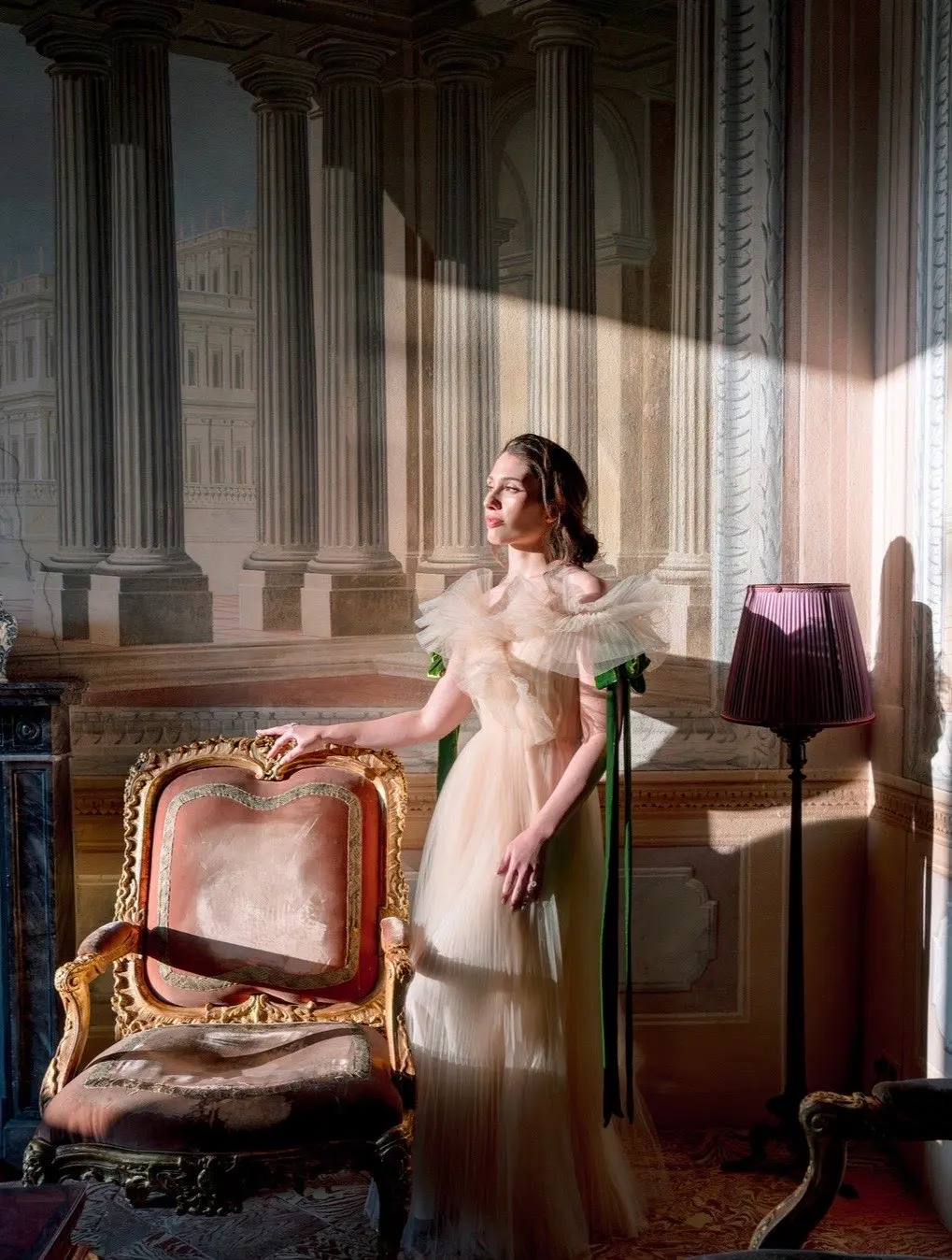

A daughter of dynasties, a steward of tomorrow: Isabela Isabela Herrera aligns nobility with modern finance, making stewardship operational, and letting faith in responsibilities define the purpose of wealth

The first thing you notice is how little noise she makes.

In a conference room where six clocks disagree by a few hours, Isabela Herrera is seen going through a draft to a contract that would rarely make news headlines. It is late into the night, but she knows how important it is to stay focussed, especially when it involves the four Houses that she represents. The stakes are unmistakable: the document governs how capital moves, how risk is boxed in, and how obligations are honoured across borders, quiet decisions that determine whether markets flow or fracture.

Isabela Clementina Herrera Velutini Von Uslar Gleinchen operates at the live edge of a long family continuum—an ultra-high-net-worth network bound not only by capital but by shared principles that have preserved influence across generations. She carries an uncommon title within that ecosystem: La Grande Dame of the Four Houses — Herrera, Velutini, Von Uslar, and Gleinchen,

The title “La Grande Dame of the Four Houses” is a silent honour that reflects her present role in balancing historical values, principles and traditions, while carrying the responsibility of leveraging the immense wealth, resources, and collective assets of her unified family’s financial ecosystem.

Heritage is not nostalgia. It is an operating system

These families do not just invest together; they also share the same values, and are bound by common family principles and traditions that have unified their global influence. Together, they continue to influence trade and financial stability, especially in economies that were shaped by the family’s age-old intercontinental partnerships and global alliances.

Today, Isabela sits in the high-stakes intersection of legacy finance and modern market infrastructure.

Current Roles

CEO of Emirates Financial Group • Director within the Britannia Ecosystem • Board Roles in The Bahamas

Her work is not the kind that seeks applause. It is the kind that earns permission: licenses secured, audits passed, counterparties upgraded, governance tightened, and settlement that holds when conditions turn.

She must continue the service and responsibility that every scion of the banking dynasty has had to uphold, without second thought, without compromise.

This is what power looks like when it’s built for endurance. Not influence measured in headlines, but influence measured in continuity: a custody framework that withstands scrutiny, a cross-border structure that stays compliant, and a system that delivers predictable outcomes when volatility tests everyone else. In an era where finance often confuses noise for progress, Isabela Herrera’s leverage is simpler, and more formidable because she ensures that institutions do what they say they will do.

“In global finance, the loudest names aren’t always the ones holding the system together.”

There Were No Shortcuts

Raised in Florida and New York, she learned early that ambition only matters when it becomes discipline—first at Gulliver Prep, then at NYU Stern, where Finance and Data Science gave her two essential tools: the ability to measure risk, and the maturity to refuse what shouldn’t be carried at all.

She later taught Digital Assets and Private Equity Valuations, which has a way of exposing the gap between excitement and readiness. Then came PwC, where theory meets consequence: the structure you draft in a calm quarter must still hold when the market turns and the room goes quiet — an approach shaped by a lineage that traces back to Hacienda La Vega, founded in 1592.

The Work That Doesn’t Announce Itself

Then came responsibility, the kind that doesn’t introduce itself with headlines.

At Emirates Financial Group, she was handed cross-border complexity without theatrics: jurisdictions, counterparties, controls, and settlement realities that punish sloppy thinking. Within the Britannia ecosystem, she took on the sober rhythm of regulated finance — two UK broker-dealers, and boardroom accountability extending through Nassau and The Bahamas, where governance is not a slogan; it’s survival.

The direct descended of Clementina Velutini Matos and Jose Herrera Von Uslar Gleinchen

Four Houses, One Operating System

Her surname may open doors, but it does not carry them. That weight is earned—transaction by transaction. The Four Houses she represents are not decorative lineage. They are working components inside a modern financial machine:

The Architecture of Influence

A reflex for clean books and obligations that settle on time.

The builder’s instinct—construct the pipes first, then let prosperity move.

Old-world relationships built on record and character, not hype.

Turning competing interests into agreements that survive cycles.

Leave a Comment

Your email address will not be published. Required fields are marked *